The blockchain landscape has evolved dramatically over the past few years. What started as a revolutionary technology for decentralized transactions has become critical infrastructure for enterprises across industries. However, with this growth comes unprecedented security challenges. From sophisticated smart contract exploits to elaborate phishing schemes, blockchain threats have become more complex and costly than ever before.

Real-time blockchain threat monitoring has emerged as a non-negotiable requirement for enterprises operating in the Web3 space. The ability to detect, analyze, and respond to threats as they happen can mean the difference between a minor security incident and a catastrophic financial loss. This comprehensive analysis examines how leading enterprises have implemented real-time blockchain monitoring solutions, the challenges they faced, and the measurable outcomes they achieved.

The following case studies represent diverse sectors within the blockchain ecosystem—from decentralized finance protocols to NFT marketplaces, regulated cryptocurrency exchanges, and enterprise supply chain implementations. Each organization faced unique security challenges that required tailored monitoring approaches, yet all discovered common principles that define effective real-time blockchain threat monitoring.

The State of Blockchain Security in 2025

Traditional security approaches cannot keep pace with blockchain-specific threats. Unlike conventional systems where security teams implement firewalls and access controls, blockchain transactions are irreversible and transparent. Once a malicious transaction executes, recovering stolen assets becomes extremely difficult, if not impossible. The statistics are sobering—blockchain-related hacks and exploits resulted in losses exceeding several billion dollars in 2024 alone, with the average detection time ranging from several hours to days without proper monitoring systems in place.

Regulatory pressure has intensified significantly as financial institutions and enterprises handling blockchain assets now face stringent compliance requirements across multiple jurisdictions. Regulators expect organizations to demonstrate robust security controls, including continuous monitoring capabilities that can detect suspicious activity in real-time. Failure to meet these standards can result in hefty fines, reputational damage, and loss of operating licenses. This regulatory environment has transformed blockchain security from a technical consideration into a fundamental business requirement.

The nature of blockchain threats has also become increasingly sophisticated. Attackers now employ complex multi-step exploits that combine smart contract vulnerabilities, oracle manipulation, flash loan attacks, and social engineering techniques. These advanced threat actors often operate with significant resources and technical expertise, making them formidable adversaries. Traditional periodic security audits, while still valuable, cannot provide the continuous protection required in this dynamic threat landscape.

Case Study 1: DeFi Protocol Prevents $50 Million Exploit

A leading decentralized finance protocol with over $2 billion in total value locked faced a critical security challenge that would test their defensive capabilities. Their platform enabled users to lend, borrow, and trade digital assets through sophisticated smart contracts that had undergone multiple security audits from reputable firms. Despite these precautions, the security team recognized that audits alone could not protect against zero-day vulnerabilities or novel attack vectors that emerge between audit cycles.

The protocol implemented a comprehensive real-time blockchain threat monitoring system that analyzed every transaction interacting with their smart contracts. The system featured advanced anomaly detection algorithms that learned normal behavior patterns for various protocol functions and flagged deviations that could indicate an exploit attempt. They also implemented smart contract invariant monitoring, which continuously verified that critical protocol rules remained intact throughout all operations. If an invariant violation occurred, automated circuit breakers could immediately pause affected contracts to prevent further damage.

Three months after implementation, the monitoring system detected an unusual transaction pattern that would prove its worth beyond expectations. A sophisticated attacker was executing a series of flash loan operations with carefully crafted abnormal parameters, attempting to manipulate a price oracle that the protocol relied upon for asset valuations. The attack was remarkably sophisticated, designed to exploit a subtle interaction between two different protocol components that had not been identified during previous security audits. The real-time monitoring system flagged the suspicious activity within seconds, and automated circuit breakers paused the affected contracts before the attacker could complete the exploit sequence that analysis later revealed would have drained approximately $50 million from the protocol. The protocol resumed normal operations within 24 hours with enhanced security controls in place, demonstrating an extraordinary return on investment while actually strengthening user trust in the platform.

Case Study 2: NFT Marketplace Combats Sophisticated Phishing

A major non-fungible token marketplace processing millions of dollars in daily trading volume faced persistent and evolving threats from phishing attacks. Sophisticated attackers created convincing fake websites that closely mimicked the legitimate marketplace interface, using advanced social engineering tactics to trick users into signing malicious transactions. These fraudulent transactions granted attackers permission to transfer valuable NFTs from victim wallets, often resulting in significant financial losses and emotional distress for collectors who lost irreplaceable digital assets.

The marketplace’s challenge was multifaceted and required careful balancing of competing priorities. They needed to protect users from increasingly sophisticated phishing schemes without creating excessive friction in the trading experience. Every additional security step or warning dialog risked frustrating legitimate users and potentially driving them to competitor platforms where the trading experience was smoother. At the same time, each successful phishing attack damaged the marketplace’s reputation and eroded the trust that users placed in the platform to protect their valuable digital assets.

The implemented real-time monitoring solution represented a breakthrough in user protection by analyzing transaction requests before users could sign them. The system examined multiple factors including the contract address being called, the specific permissions being requested, the transaction value, and how these elements compared to the user’s historical behavior patterns. This analysis happened in milliseconds to avoid introducing noticeable latency that would degrade the user experience. Within the first month of deployment, the system prevented over 500 phishing attempts, protecting assets worth more than $3 million, while user complaints about phishing scams dropped by 78 percent. The monitoring system also provided valuable threat intelligence by identifying new attack patterns and enabling the preemptive blocking of wallet drainer contracts that were being used across multiple phishing campaigns.

Case Study 3: Cryptocurrency Exchange Enhances AML Compliance

A regulated cryptocurrency exchange operating across multiple jurisdictions needed to strengthen their anti-money laundering capabilities to meet increasingly stringent regulatory requirements. Their existing compliance infrastructure, originally designed for traditional financial transactions, struggled with the unique challenges of blockchain analysis. The compliance team relied heavily on manual review processes that created bottlenecks, slowing customer onboarding and withdrawal processing while failing to provide the comprehensive monitoring that regulators expected.

The exchange implemented a comprehensive real-time blockchain monitoring platform that automated much of their compliance workflow while improving detection accuracy. The system integrated with multiple blockchain networks, analyzing both on-chain activity and exchange transactions to build complete transaction graphs that revealed relationships and fund flows. Real-time risk scoring evaluated every deposit and withdrawal, examining factors including the address’s transaction history, connections to known high-risk entities, exposure to sanctioned addresses, and patterns consistent with money laundering techniques such as layering or structuring.

Within six months of implementation, the exchange achieved remarkable improvements in their compliance operations. The time required to review and approve customer withdrawals decreased by 65 percent, allowing the compliance team to focus on genuinely high-risk cases rather than manually reviewing every transaction. False positive rates declined significantly through iterative refinement and machine learning integration, as the system learned to distinguish between genuinely suspicious patterns and normal user behavior. The platform’s real-time capabilities proved particularly valuable during several high-profile security incidents affecting other exchanges, immediately flagging any deposits from addresses associated with stolen funds and preventing money laundering attempts. Regulatory audits became substantially smoother as the monitoring system maintained comprehensive audit trails demonstrating exactly what monitoring capabilities were in place.

Case Study 4: Enterprise Blockchain for Supply Chain

A multinational corporation implemented a private blockchain network to track high-value goods through their complex global supply chain. The system recorded custody transfers between authorized parties, quality certifications from inspection facilities, and shipping milestones as immutable blockchain transactions. This transparency aimed to prevent counterfeiting, ensure product authenticity, and provide customers with verifiable proof of origin and handling throughout the supply chain.

Real-time blockchain threat monitoring became a critical component of their security architecture to ensure data integrity and prevent unauthorized modifications to supply chain records. While blockchain’s immutability provided protection against tampering with existing records, the permissioned network still faced insider threat risks where authorized participants could potentially create fraudulent new records if proper monitoring was not in place. The monitoring solution tracked several key security indicators, verifying that transactions came from authorized addresses for specific supply chain actions, checking that transaction timestamps aligned with physical logistics data, and ensuring custody transfers followed the correct sequence without skipping intermediate checkpoints.

Six months into operation, the monitoring system detected a significant anomaly that demonstrated its value for maintaining supply chain integrity. A series of quality certification transactions were being submitted from an authorized address, but the timestamps revealed an impossible scenario where certifications allegedly occurred before goods physically arrived at the inspection facility. Investigation revealed that a quality control employee had been backdating certifications to cover up missed inspections, potentially allowing defective or counterfeit products to enter the market. The monitoring system’s timestamp verification caught this scheme before any compromised products reached customers. Following this incident, the corporation expanded their monitoring capabilities to cross-reference blockchain data with external systems like GPS tracking for shipments and third-party quality control databases, while also gaining unexpected operational efficiency benefits through visibility that enabled process improvements reducing delivery times by 12 percent.

Key Components of Effective Real-Time Blockchain Monitoring

The case studies reveal several common patterns among successful real-time blockchain threat monitoring implementations. Transaction analysis forms the foundation, examining multiple dimensions including the transaction sender, receiver, value, gas usage, contract functions called, and parameters passed while building comprehensive transaction graphs showing relationships between addresses over time. Behavioral anomaly detection uses machine learning models to establish baselines for expected behavior and flag significant deviations, catching novel attack techniques that signature-based detection would miss.

Smart contract monitoring verifies that contracts execute as intended by checking invariants that should always hold true, monitoring state changes for unexpected patterns, and detecting exploitation techniques like reentrancy attempts. Threat intelligence integration enhances detection capabilities by ingesting data about known malicious addresses, emerging attack patterns, and vulnerability disclosures. Automated response capabilities enable rapid threat mitigation through actions like pausing contracts, blocking transactions, or freezing assets when critical threats are detected.

Alert management and investigation workflows ensure that security teams can efficiently respond to detected threats with proper prioritization based on severity and rich context for investigations. Performance and scalability prove critical as systems must analyze transactions with minimal latency to enable timely responses, requiring efficient data processing architectures, optimized algorithms, and infrastructure that scales seamlessly with growing transaction volumes.

Implementing Real-Time Blockchain Monitoring: Best Practices

Organizations implementing real-time blockchain monitoring should start with clear security objectives that define what threats the monitoring system needs to detect and what outcomes they want to achieve. Different use cases require fundamentally different monitoring approaches—a DeFi protocol faces different threats than an enterprise supply chain blockchain. Quality data infrastructure is essential, with reliable low-latency access to blockchain data through owned nodes for maximum control, enterprise node providers for managed solutions, or hybrid approaches that balance performance and operational complexity.

Monitoring rules should develop iteratively rather than attempting to build comprehensive coverage from day one. Begin with simple, high-confidence detection rules that catch the most critical threats with minimal false positives. Measure both false positive and false negative rates carefully, refining rules based on operational experience and gradually adding more sophisticated detection capabilities as understanding of the specific threat landscape improves. Balance automation with human judgment by using automated responses for clear-cut threats where false positives have minimal impact, while leveraging human review for complex scenarios that benefit from experienced security analysis before taking action.

Maintain comprehensive audit trails that record all monitoring decisions, alerts generated, and actions taken. This documentation proves essential for incident investigations, regulatory compliance demonstrations, and continuous improvement of monitoring capabilities. Test monitoring systems thoroughly through simulated attack scenarios that verify detection works correctly and conduct red team exercises where security professionals attempt to bypass monitoring controls. Plan for monitoring system reliability since the monitoring itself becomes a critical security control that must be highly available and resilient, implementing redundancy, monitoring of the monitoring system itself, and robust disaster recovery capabilities.

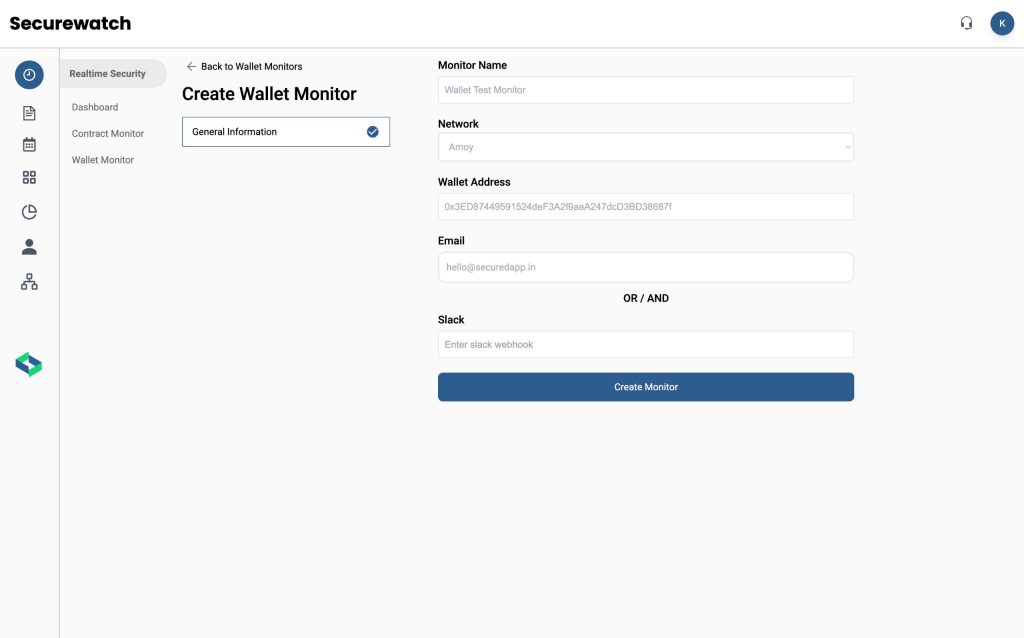

Integration with SecureDApp Platform

SecuredApp.io provides comprehensive blockchain security solutions that directly address the challenges highlighted throughout these case studies. Our platform combines real-time threat monitoring with advanced analytics and machine learning to protect enterprises operating across the blockchain ecosystem. The monitoring engine analyzes transactions across multiple blockchain networks in real-time, detecting suspicious patterns and potential exploits before they result in financial losses through sophisticated machine learning models trained on extensive historical attack data and automated circuit breakers that can pause vulnerable contracts while security teams investigate potential threats.

For DeFi protocols, SecuredApp.io monitors smart contract interactions with deep visibility, verifies critical invariants continuously, and detects oracle manipulation attempts before they can be exploited. Our platform integrates seamlessly with major DeFi protocols, providing granular visibility into lending, borrowing, and trading activities while enabling security teams to define custom alerting rules specific to their protocol’s unique risk profile. NFT marketplaces benefit from our sophisticated transaction signing analysis that protects users from phishing attacks by analyzing requested permissions in real-time, comparing them against known malicious patterns, and providing users with clear warnings about suspicious transactions before they sign, effectively preventing wallet drainer attacks and unauthorized token transfers.

Cryptocurrency exchanges and financial institutions leverage our AML monitoring solution that automates complex compliance workflows while maintaining high accuracy. We build comprehensive transaction graphs that reveal hidden relationships, identify high-risk counterparties through sophisticated analysis, and generate suspicious activity reports that satisfy regulatory requirements across multiple jurisdictions. Our risk scoring models have been refined through extensive deployment to reduce false positives while maintaining exceptionally high detection rates for genuinely suspicious activity. Enterprise blockchain implementations utilize our specialized permissioned network monitoring capabilities that verify transactions follow expected business logic, detect insider threats through behavioral analysis, and ensure data integrity through integration with existing enterprise systems that enable cross-validation of blockchain data against authoritative sources.

Conclusion

The case studies examined throughout this analysis demonstrate conclusively that real-time blockchain threat monitoring has evolved from an optional enhancement to an essential security control for any organization operating in the blockchain space. Organizations face increasingly sophisticated threats that can result in catastrophic financial losses, regulatory penalties, and permanent reputational damage that can destroy even well-established projects.

Effective monitoring requires combining multiple technical capabilities including comprehensive transaction analysis, behavioral anomaly detection, smart contract monitoring, and threat intelligence integration. Successful implementations balance automation with human judgment, invest in quality data infrastructure while maintaining operational agility, and continuously evolve their monitoring capabilities to address emerging threats. The business case for real-time monitoring is compelling across multiple dimensions, with direct financial protection, regulatory compliance, reputation management, and operational efficiency all contributing to strong return on investment that justifies the implementation costs.

For enterprises serious about blockchain security, the question is not whether to implement real-time monitoring but how quickly and comprehensively they can deploy these critical capabilities. The case studies presented here show that early adopters gain significant competitive advantages through superior security postures, while late movers face the challenging task of catching up as threats continue growing more sophisticated and regulatory requirements become more stringent. The time to act is now.

FAQ

Real-time blockchain threat monitoring is a security approach that continuously analyzes blockchain transactions as they occur to detect suspicious patterns, potential exploits, and malicious activity before they result in financial losses. Unlike traditional periodic security audits, real-time monitoring provides immediate alerts and can trigger automated responses like pausing vulnerable smart contracts or blocking suspicious transactions. The system examines multiple factors including transaction patterns, smart contract interactions, wallet behaviors, and known threat indicators to identify attacks within seconds of initiation.

The cost of implementing real-time blockchain monitoring varies based on several factors including transaction volumes, number of blockchain networks monitored, complexity of smart contracts, and desired response capabilities. However, the return on investment is typically substantial—as demonstrated in our case studies, a single prevented exploit can save millions of dollars, far exceeding annual monitoring costs.

While real-time blockchain threat monitoring significantly reduces risk and can prevent many attacks, no security solution can guarantee 100% protection against all threats. Monitoring is most effective when combined with other security measures including thorough smart contract audits, secure development practices, multi-signature controls, and user education. The goal is to create defense-in-depth where multiple security layers work together.

Smart contract audits and real-time monitoring serve complementary but distinct purposes. Security audits are point-in-time assessments conducted before deployment where experts review code for vulnerabilities, logic errors, and security weaknesses. Audits are essential for identifying issues during development but cannot protect against attacks that occur after deployment, zero-day vulnerabilities discovered later, or exploits involving interactions between multiple protocols.