The cryptocurrency exchange landscape faces unprecedented security challenges. Every day brings new threats that can compromise millions in digital assets. Traditional security measures no longer suffice in this rapidly evolving environment. Real-time blockchain threat monitoring has emerged as a critical defense mechanism. It provides exchanges with immediate visibility into suspicious activities and potential vulnerabilities. This proactive approach helps prevent breaches before they cause catastrophic damage. Modern exchanges process billions of dollars in transactions daily. A single security lapse can destroy user trust and lead to regulatory penalties. The stakes have never been higher for implementing robust monitoring systems.

Understanding the Threat Landscape in Cryptocurrency Exchanges

Cryptocurrency exchanges operate in a uniquely hostile environment. Hackers view these platforms as high-value targets with potentially massive payoffs. The digital nature of crypto assets makes them particularly vulnerable to sophisticated attacks. Recent data shows that exchange hacks have cost the industry over $3 billion since 2019. These incidents range from smart contract exploits to social engineering attacks. Each breach highlights the need for comprehensive security monitoring.

The threat vectors continue to multiply. Attackers now employ advanced techniques including flash loan attacks, front-running, and cross-chain exploits. Traditional security tools struggle to detect these novel attack patterns in real-time. Internal threats pose equally serious risks. Privileged users with system access can potentially manipulate transactions or steal credentials. Without proper monitoring, these insider threats can go undetected for months.

The Critical Role of Real-Time Blockchain Threat Monitoring

Real-time blockchain threat monitoring transforms how exchanges detect and respond to security incidents. It provides continuous surveillance across all transaction layers and system components. This constant vigilance enables security teams to identify anomalies as they occur. The blockchain’s transparent nature actually works to security’s advantage. Every transaction leaves an immutable trail that monitoring systems can analyze. This creates opportunities to spot suspicious patterns before damage occurs.

Speed matters tremendously in threat detection. A monitoring system that identifies a breach minutes earlier can prevent millions in losses. Real-time capabilities reduce the window of opportunity for attackers to exploit vulnerabilities. Modern monitoring solutions leverage machine learning to establish baseline behaviors. They can then flag deviations that might indicate compromise or attack. This intelligent approach reduces false positives while improving detection accuracy.

Key Components of Effective Monitoring Systems

Transaction monitoring forms the foundation of exchange security. Systems must analyze every blockchain transaction for signs of manipulation or fraud. This includes tracking wallet addresses, transaction amounts, and transfer patterns. Network activity monitoring provides crucial context for security assessments. Unusual login patterns, API usage spikes, or geographic anomalies can signal account compromise. These behavioral indicators often precede actual theft attempts.

Smart contract monitoring has become essential as DeFi integration grows. Automated systems must scan contract code for vulnerabilities and monitor execution for unexpected behaviors. This prevents exploit-based attacks that target protocol weaknesses. Wallet security monitoring tracks hot and cold wallet activities continuously. Unexpected withdrawal requests or address changes trigger immediate alerts. This layer protects the exchange’s core asset storage from unauthorized access.

Implementing Multi-Layer Security Architecture

A robust security architecture requires multiple defensive layers working in concert. Each layer addresses specific threat categories while supporting overall system resilience. This defense-in-depth strategy ensures no single point of failure exists. The perimeter layer focuses on network-level threats and unauthorized access attempts. Firewalls, intrusion detection systems, and DDoS protection establish the first line of defense. These tools filter out obvious attacks before they reach critical systems.

Application-layer security monitors user interactions and API calls for suspicious patterns. Rate limiting, input validation, and session management prevent common attack vectors. This layer catches threats that bypass perimeter defenses. Data-layer protection ensures transaction integrity and prevents unauthorized modifications. Encryption, access controls, and audit logging maintain data confidentiality and accountability. These measures protect against both external and internal threats.

Integration with Blockchain Networks

Effective monitoring requires direct integration with blockchain networks. Exchanges must maintain full nodes or reliable node connections for real-time data access. This ensures monitoring systems receive transaction data without delay. Cross-chain monitoring presents unique challenges as exchanges support multiple cryptocurrencies. Each blockchain has distinct characteristics, consensus mechanisms, and potential vulnerabilities. Monitoring solutions must adapt to these differences while maintaining consistent security standards.

Mempool monitoring provides early warning of potential attacks. By analyzing pending transactions, security systems can identify suspicious patterns before block confirmation. This proactive approach enables faster response to emerging threats. Smart contract event monitoring tracks on-chain activities related to exchange operations. Deposit confirmations, withdrawal executions, and token swaps all generate events that require verification. Automated monitoring ensures these events match expected patterns.

Advanced Threat Detection Techniques

Machine learning algorithms excel at identifying anomalous patterns in vast transaction datasets. These systems learn normal behavior and flag statistical outliers that might indicate attacks. Continuous training improves detection accuracy over time. Behavioral analysis examines user actions across multiple dimensions. Login times, trading patterns, withdrawal frequencies, and IP addresses create unique behavioral fingerprints. Deviations from established patterns trigger security reviews.

Predictive analytics uses historical data to forecast potential attack vectors. By identifying trends and correlations, these systems help security teams prepare for emerging threats. This forward-looking approach strengthens overall security posture. Graph analysis reveals relationships between wallet addresses and transaction flows. Attackers often use complex laundering schemes involving multiple addresses. Graph-based detection uncovers these hidden connections and trace stolen funds.

Real-Time Alert Systems and Response Protocols

Automated alert systems must balance sensitivity with practicality. Too many false alarms create alert fatigue and reduce response effectiveness. Proper calibration ensures security teams focus on genuine threats. Alert prioritization categorizes threats by severity and potential impact. Critical alerts demand immediate attention while lower-priority items enter workflow queues. This triage approach optimizes resource allocation during security incidents.

Integration with incident response platforms enables coordinated reactions to threats. When monitoring detects suspicious activity, automated workflows can freeze accounts, suspend withdrawals, or isolate affected systems. These rapid responses limit potential damage. Communication protocols ensure all stakeholders receive timely threat information. Security teams, management, compliance officers, and potentially affected users need appropriate notifications. Clear communication channels prevent confusion during crisis situations.

Compliance and Regulatory Considerations

Regulatory frameworks increasingly mandate robust security monitoring for cryptocurrency exchanges. Financial authorities worldwide require demonstrable security controls and audit trails. Real-time monitoring helps exchanges meet these evolving compliance requirements. Anti-money laundering regulations demand transaction monitoring capabilities. Exchanges must identify and report suspicious activities that might indicate money laundering. Automated monitoring systems track patterns consistent with regulatory definitions.

Know Your Customer requirements extend into transaction monitoring. Exchanges must verify that account activities align with stated user profiles and risk assessments. Unusual patterns may trigger enhanced due diligence procedures. Data retention policies require comprehensive logging of all security events and transactions. Monitoring systems must capture and store this information in tamper-proof formats. These records support investigations, audits, and regulatory examinations.

Building Audit Trails and Forensic Capabilities

Comprehensive audit trails document every system action and transaction. These logs provide crucial evidence during security investigations and compliance audits. Immutable logging prevents attackers from covering their tracks. Forensic analysis tools reconstruct attack timelines and identify compromise vectors. When breaches occur, these capabilities help teams understand what happened and prevent recurrence. Detailed forensics also support law enforcement investigations.

Chain of custody procedures ensure evidence integrity for potential legal proceedings. Proper documentation and secure storage of forensic data maintain its admissibility. This becomes critical when prosecuting attackers or pursuing asset recovery. Incident post-mortems extract lessons from security events. Analyzing monitoring data reveals gaps in detection capabilities and response procedures. These insights drive continuous security improvements.

SecureDApp’s Approach to Exchange Security

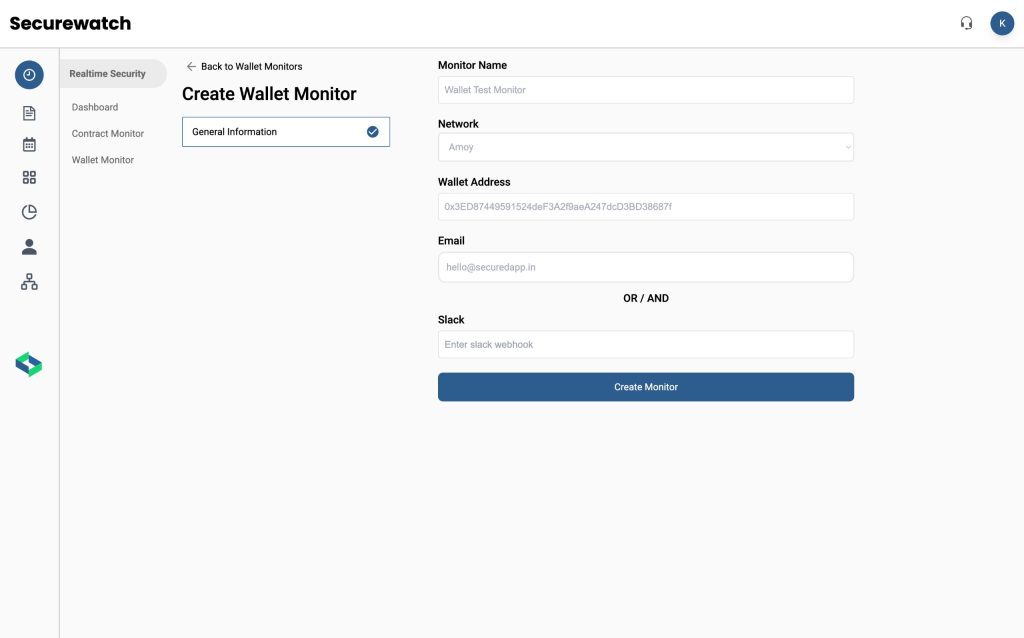

SecureDApp provides comprehensive real-time blockchain threat monitoring tailored for cryptocurrency exchanges. Our platform integrates seamlessly with existing infrastructure while delivering advanced detection capabilities. We understand the unique challenges exchanges face in this high-stakes environment. Our monitoring solution analyzes transactions across multiple blockchain networks simultaneously. This cross-chain visibility ensures comprehensive threat detection regardless of which assets your exchange supports. Pattern recognition algorithms identify suspicious activities in real-time.

Customizable alert rules allow exchanges to define security parameters matching their risk tolerance. Whether monitoring for unusual withdrawal patterns, smart contract interactions, or account behaviors, our platform adapts to your needs. Configuration flexibility ensures relevance to your specific operational context. Integration capabilities extend to existing security infrastructure and incident response tools. SecureDApp works alongside your current systems, enhancing rather than replacing proven solutions. API connectivity enables automated workflows and coordinated responses.

Practical Implementation Strategies

Successful monitoring implementation begins with comprehensive risk assessment. Identify your exchange’s most critical assets, likely attack vectors, and potential vulnerabilities. This analysis guides monitoring configuration and resource allocation. Phased deployment minimizes disruption while building robust security capabilities. Start with high-priority monitoring functions like withdrawal tracking and suspicious login detection. Gradually expand coverage to include transaction pattern analysis and smart contract monitoring.

Staff training ensures security teams can effectively leverage monitoring tools. Understanding alert interpretation, investigation procedures, and response protocols maximizes system value. Regular training updates keep teams current on emerging threats. Continuous optimization refines monitoring parameters based on operational experience. Regular reviews of alert patterns, false positive rates, and missed detections identify improvement opportunities. This iterative approach enhances effectiveness over time.

Performance Optimization and Scalability

High-volume exchanges require monitoring systems that scale with transaction throughput. Performance optimization ensures real-time analysis even during peak trading periods. Latency in threat detection can mean the difference between prevention and catastrophic loss. Distributed architecture spreads monitoring workloads across multiple processing nodes. This horizontal scaling approach handles growing transaction volumes without compromising detection speed. Load balancing maintains consistent performance during traffic spikes.

Efficient data processing algorithms minimize computational overhead. Smart filtering reduces unnecessary analysis while maintaining comprehensive coverage. This balance between thoroughness and performance sustains real-time capabilities. Caching strategies store frequently accessed data for rapid retrieval. Pattern libraries, rule sets, and behavioral baselines benefit from caching optimization. Reduced database queries improve overall system responsiveness.

Cloud-Based vs. On-Premises Solutions

Cloud-based monitoring offers rapid deployment and elastic scalability. Resources adjust automatically to match demand without infrastructure management overhead. This flexibility appeals to exchanges experiencing rapid growth. On-premises solutions provide complete control over sensitive security data. Some exchanges prefer keeping monitoring infrastructure within their own facilities for compliance or security reasons. This approach requires greater technical resources but offers maximum autonomy.

Hybrid architectures combine cloud and on-premises elements strategically. Critical monitoring functions might run on-premises while less sensitive operations leverage cloud scalability. This balanced approach optimizes both control and flexibility. Cost considerations influence infrastructure decisions significantly. Cloud solutions typically involve operational expenses while on-premises requires capital investment. Total cost of ownership calculations should include staffing, maintenance, and upgrade costs.

Integration with Incident Response Workflows

Effective monitoring must connect seamlessly with incident response procedures. Detection without appropriate response fails to prevent damage. Automated workflows translate alerts into immediate protective actions. Playbook automation executes predefined response sequences when specific threats emerge. Account suspension, transaction holds, and system isolation can occur within seconds. This rapid response limits attacker opportunities and contains potential damage.

Collaboration tools facilitate coordination among distributed security teams. When monitoring detects threats, all relevant personnel receive notifications through appropriate channels. Shared dashboards provide common operational pictures during incidents.Documentation automation captures response actions and decision points. This creates accountability while building institutional knowledge for future incidents. Automated reporting reduces manual effort during high-stress situations.

Measuring Security Effectiveness

Key performance indicators quantify monitoring system effectiveness. Metrics like mean time to detection, false positive rates, and incident resolution speed reveal system performance. Regular measurement drives continuous improvement. Threat intelligence integration enhances monitoring relevance. External threat feeds provide context about emerging attack techniques and compromised indicators. This information helps monitoring systems recognize new threat patterns.

Penetration testing validates monitoring capabilities under realistic conditions. Simulated attacks reveal gaps in detection coverage and response procedures. Regular testing ensures systems perform as expected when real threats emerge. Benchmarking against industry standards provides performance context. Understanding how your monitoring capabilities compare to best practices identifies improvement opportunities. This external perspective complements internal metrics.

Future Trends in Exchange Security Monitoring

Artificial intelligence continues evolving threat detection capabilities. Advanced models will identify increasingly subtle attack patterns and predict threats before they materialize. This evolution will further shift security from reactive to proactive. Quantum computing presents both opportunities and challenges for blockchain security. While quantum threats to cryptographic systems loom, quantum-enabled monitoring may detect patterns beyond classical computing capabilities. Exchanges must prepare for this paradigm shift.

Decentralized monitoring solutions may emerge as blockchain technology matures. Community-driven threat intelligence and distributed detection networks could complement centralized systems. This collaborative approach might identify threats no single entity would detect alone. Regulatory evolution will drive monitoring requirements in new directions. Privacy regulations, cross-border compliance, and standardized security frameworks will shape monitoring capabilities. Adaptive systems will need to accommodate changing regulatory landscapes.

Conclusion

Real-time blockchain threat monitoring represents an essential investment for cryptocurrency exchanges. The cost of implementing robust monitoring pales compared to potential breach losses. More importantly, effective monitoring protects the user trust that forms the foundation of exchange success. Security threats will continue evolving as the cryptocurrency ecosystem matures. Exchanges that prioritize comprehensive monitoring position themselves to adapt to emerging challenges. This forward-thinking approach builds resilience into operations.

The technology enabling effective monitoring continues advancing rapidly. Exchanges should regularly reassess their security posture and monitoring capabilities. Staying current with best practices ensures long-term security and competitiveness. SecureApp stands ready to support exchanges in implementing world-class security monitoring. Our expertise in real-time blockchain threat monitoring helps exchanges protect assets and maintain user confidence. Together, we can build a more secure cryptocurrency ecosystem.

FAQ

Real-time blockchain threat monitoring is a security system that continuously analyzes blockchain transactions and network activities as they occur. It detects suspicious patterns, unauthorized access attempts, and potential vulnerabilities instantly. This proactive approach enables exchanges to respond to threats before they cause significant damage.

Traditional security relies on periodic audits and reactive responses after incidents occur. Real-time monitoring provides continuous surveillance and immediate alerts when anomalies are detected. This approach significantly reduces the window of opportunity for attackers. It also enables automated responses that can contain threats within seconds.

Monitoring systems identify various threats including unauthorized withdrawal attempts, unusual login patterns, and smart contract exploits. They also detect flash loan attacks, account takeovers, and money laundering activities. Advanced systems recognize insider threats and API abuse. Pattern recognition capabilities help identify previously unknown attack vectors.

Implementation costs vary based on exchange size, transaction volume, and feature requirements. Cloud-based solutions typically range from $5,000 to $50,000 monthly depending on scale. On-premises deployments require higher upfront investment but lower ongoing costs. The investment is minimal compared to potential losses from security breaches.

Modern monitoring platforms are designed to scale with transaction volumes. Distributed architectures and efficient processing algorithms maintain real-time performance during peak periods. Cloud-based solutions offer elastic scalability that adjusts resources automatically. Proper implementation ensures monitoring effectiveness regardless of exchange size or trading volume.