Blockchain technology has revolutionized financial transactions and digital asset management. However, this innovation brings significant regulatory challenges for organizations. Real-time blockchain threat monitoring has become essential for compliance with evolving regulatory frameworks. Financial institutions and crypto businesses must navigate complex requirements while maintaining operational efficiency. This comprehensive guide explores compliance requirements for blockchain monitoring. We examine regulatory standards, implementation strategies, and best practices for organizations operating in the digital asset space.

Understanding Real-Time Blockchain Threat Monitoring

Real-time blockchain threat monitoring involves continuous surveillance of blockchain transactions. This process identifies suspicious activities, potential fraud, and compliance violations as they occur. Traditional monitoring methods cannot keep pace with blockchain transaction speeds. Real-time systems analyze thousands of transactions per second, flagging anomalies instantaneously. Modern monitoring solutions integrate artificial intelligence and machine learning algorithms. These technologies detect patterns that human analysts might miss, improving threat detection accuracy significantly.

Regulatory Landscape for Blockchain Monitoring

Global Regulatory Framework

Financial authorities worldwide have established stringent requirements for blockchain monitoring. The Financial Action Task Force (FATF) leads international efforts to standardize crypto asset regulation. FATF’s Travel Rule requires virtual asset service providers to share customer information. This regulation applies to transactions exceeding specific thresholds, typically $1,000 or equivalent amounts. European Union’s Markets in Crypto-Assets Regulation (MiCA) introduces comprehensive compliance standards. Organizations must implement robust monitoring systems to meet these stringent requirements effectively.

United States Regulatory Requirements

The Bank Secrecy Act (BSA) mandates financial institutions to monitor suspicious activities. Blockchain businesses must file Suspicious Activity Reports (SARs) when detecting potential money laundering. FinCEN requires cryptocurrency exchanges to implement comprehensive compliance programs. These programs must include real-time monitoring capabilities and customer due diligence procedures. The Securities and Exchange Commission (SEC) oversees crypto asset securities compliance. Organizations must ensure their monitoring systems detect potential securities law violations promptly.

Core Compliance Requirements

Know Your Customer (KYC) Protocols

KYC procedures form the foundation of blockchain compliance programs. Organizations must verify customer identities before allowing blockchain transactions or account access. Real-time blockchain threat monitoring systems integrate with KYC databases continuously. This integration enables immediate verification of transaction participants against sanctioned entities lists. Enhanced due diligence applies to high-risk customers and jurisdictions. Monitoring systems must flag transactions involving these entities for manual review and approval.

Anti-Money Laundering (AML) Standards

AML compliance requires organizations to detect and prevent money laundering activities. Real-time monitoring identifies structuring, layering, and integration patterns associated with illicit funds. Transaction monitoring rules must cover various typologies and red flags. Systems analyze transaction amounts, frequencies, and patterns to identify suspicious behaviors. Organizations must maintain comprehensive audit trails of all monitoring activities. These records demonstrate compliance efforts during regulatory examinations and investigations.

Sanctions Screening Obligations

Sanctions screening prevents transactions with designated individuals and entities. Monitoring systems check blockchain addresses against Office of Foreign Assets Control (OFAC) lists. Real-time screening must occur before transaction execution whenever possible. This proactive approach prevents inadvertent sanctions violations and associated penalties. rganizations must update sanctions lists immediately when authorities publish changes. Delayed updates create compliance gaps and expose organizations to regulatory enforcement actions.

Technical Implementation Requirements

System Architecture Standards

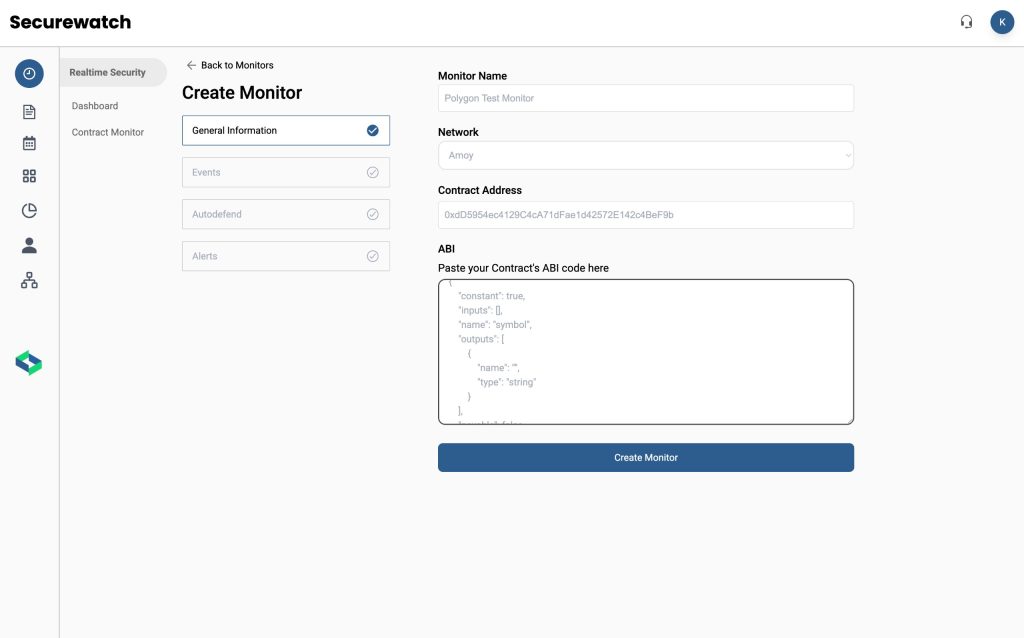

Effective monitoring systems require robust and scalable architecture. Infrastructure must handle high transaction volumes without compromising detection accuracy or speed. Cloud-based solutions offer flexibility and scalability for growing organizations. These platforms provide redundancy and disaster recovery capabilities essential for compliance continuity.

Integration with existing compliance systems streamlines workflows and reduces operational costs. Organizations should prioritize solutions offering comprehensive API connectivity and data exchange capabilities. SecuredApp.io provides enterprise-grade blockchain monitoring infrastructure that meets regulatory requirements. Our platform scales automatically to handle transaction volume spikes while maintaining real-time analysis.

Data Collection and Analysis

Comprehensive data collection forms the basis of effective threat monitoring. Systems must capture transaction details, wallet addresses, smart contract interactions, and metadata. Machine learning models analyze collected data to identify suspicious patterns. These algorithms improve continuously, adapting to new threat vectors and criminal methodologies. Transaction graph analysis reveals relationships between blockchain addresses and entities. This technique exposes complex money laundering schemes involving multiple intermediary wallets.

Alert Management Systems

Alert systems must balance sensitivity with practicality to avoid overwhelming compliance teams. Well-calibrated rules reduce false positives while ensuring genuine threats receive immediate attention. Risk-based scoring helps prioritize alerts for investigation and response. High-risk transactions trigger immediate notifications, while lower-risk activities queue for routine review. Case management tools track alert investigation from detection through resolution. These systems maintain detailed records required for regulatory reporting and audit purposes.

Threat Detection Capabilities

Transaction Pattern Analysis

Pattern recognition identifies behaviors indicative of illicit activities. Monitoring systems detect structuring, rapid movement of funds, and circular transaction patterns. Velocity checks monitor transaction frequency and amounts over specific timeframes. Unusual spikes trigger alerts for potential account takeover or money laundering attempts. Geographic analysis evaluates transactions involving high-risk jurisdictions. Systems flag activities originating from or destined to countries with weak AML controls.

Smart Contract Monitoring

Smart contracts present unique compliance challenges requiring specialized monitoring approaches. Systems must analyze contract code and execution patterns for suspicious activities. Decentralized finance (DeFi) protocols require continuous surveillance for protocol exploitation. Monitoring identifies flash loan attacks, reentrancy exploits, and oracle manipulation attempts. Token transfer monitoring tracks movements between wallets and smart contracts. This visibility helps detect mixer services and privacy protocol usage for illicit purposes.

Risk Scoring Methodologies

Risk scoring assigns numerical values to transactions based on multiple factors. This approach enables efficient resource allocation for compliance team investigations. Dynamic scoring adjusts risk levels as new information becomes available. Systems update scores continuously, reflecting changing threat landscapes and regulatory guidance. Customizable scoring parameters allow organizations to align with risk appetites. Businesses can adjust thresholds based on their specific compliance requirements and operational contexts.

Reporting and Documentation Requirements

Suspicious Activity Reporting

Organizations must file timely SARs when detecting suspicious blockchain activities. Real-time monitoring enables rapid identification and reporting within regulatory deadlines. SAR narratives require detailed transaction information and supporting documentation. Monitoring systems should compile relevant data automatically to streamline report preparation. Continuing activity reports update authorities on ongoing suspicious patterns. Systems must track related transactions and generate supplemental reports as situations develop.

Audit Trail Maintenance

Comprehensive audit trails document all monitoring activities and decisions. These records prove compliance efforts during regulatory examinations and legal proceedings. Record retention policies must comply with jurisdiction-specific requirements. Most regulators mandate maintaining records for five to seven years minimum. Immutable logging systems prevent tampering with compliance records. Blockchain-based audit logs provide cryptographic proof of record integrity for regulatory verification.

Regulatory Reporting Obligations

Regular reporting to supervisory authorities demonstrates ongoing compliance commitment. Organizations must submit transaction monitoring statistics and program effectiveness metrics. Currency transaction reports (CTRs) document large cryptocurrency transactions. Automated reporting systems ensure timely submission of required regulatory filings. Cross-border transaction reporting helps authorities track international money flows. Organizations must identify and report transactions exceeding specified thresholds promptly.

Implementation Best Practices

Risk Assessment Frameworks

Organizations must conduct comprehensive risk assessments before implementing monitoring systems. These assessments identify specific threats relevant to business models and customer bases. Risk assessments should evaluate product offerings, geographic exposures, and customer demographics. Understanding these factors enables targeted monitoring rule configuration. Regular reassessments ensure monitoring programs adapt to evolving threats. Organizations should review risk profiles quarterly or when significant business changes occur.

Staff Training and Awareness

Compliance effectiveness depends heavily on staff competency and awareness. Organizations must provide comprehensive training on monitoring systems and regulatory requirements. Training programs should cover threat typologies, alert investigation procedures, and reporting obligations. Regular refresher courses keep teams updated on regulatory changes. Specialized training for technical teams ensures proper system configuration and maintenance. These professionals must understand both compliance requirements and technical implementation details.

Vendor Selection Criteria

Selecting the right monitoring solution provider significantly impacts compliance success. Organizations should evaluate vendors based on technical capabilities, regulatory expertise, and support services. Vendor solutions must demonstrate proven effectiveness in detecting blockchain threats. Request case studies and references from similar organizations before making decisions.

Integration capabilities determine how smoothly new systems work with existing infrastructure. Prioritize vendors offering comprehensive APIs and compatibility with current technology stacks. SecuredApp.io offers industry-leading blockchain monitoring solutions designed specifically for regulatory compliance. Our platform combines advanced threat detection with intuitive case management tools.

Challenges in Real-Time Monitoring

Privacy Coin Complications

Privacy-focused cryptocurrencies present significant monitoring challenges for compliance teams. These assets employ advanced cryptographic techniques that obscure transaction details. Regulatory authorities increasingly scrutinize privacy coin usage for potential money laundering. Organizations must implement enhanced monitoring for customers transacting with these assets. Some jurisdictions prohibit privacy coin trading entirely to mitigate compliance risks. Businesses must stay informed about regulatory positions on these controversial digital assets.

Cross-Chain Transaction Tracking

Multi-blockchain transactions complicate monitoring efforts significantly. Funds moving across different blockchains require specialized tools for complete visibility. Bridge protocols enable asset transfers between blockchains with varying transparency levels. Monitoring systems must track these movements to detect money laundering schemes. Atomic swaps allow direct peer-to-peer cryptocurrency exchanges without intermediaries. These transactions bypass traditional monitoring checkpoints, creating compliance blind spots.

Scalability Considerations

Transaction volume growth strains monitoring system performance and accuracy. Organizations must ensure infrastructure scales appropriately to maintain real-time analysis capabilities. False positive rates increase when systems operate beyond designed capacity. Overwhelmed compliance teams cannot investigate alerts effectively, reducing overall program effectiveness. Cloud infrastructure provides elastic scalability for handling transaction volume fluctuations. Organizations should implement auto-scaling solutions that adjust resources based on demand.

Future Regulatory Developments

Emerging Compliance Standards

Regulatory frameworks continue evolving as authorities gain blockchain expertise. Organizations must monitor regulatory developments closely to maintain compliance status. International harmonization efforts aim to standardize blockchain compliance requirements globally. These initiatives will simplify compliance for organizations operating across multiple jurisdictions. Stablecoin regulations represent a significant focus area for financial authorities worldwide. New requirements will likely mandate enhanced monitoring for stablecoin transactions and reserves.

Technology Advancement Impact

Artificial intelligence capabilities continue improving threat detection accuracy and efficiency. Machine learning models will become increasingly sophisticated in identifying complex criminal schemes. Quantum computing developments may revolutionize both blockchain security and monitoring approaches. Organizations must prepare for potential paradigm shifts in cryptographic standards. Zero-knowledge proof technology offers privacy while maintaining compliance capabilities. These innovations may resolve tensions between user privacy and regulatory transparency requirements.

Building an Effective Compliance Program

Governance Framework

Strong governance provides the foundation for successful compliance programs. Executive leadership must demonstrate commitment to regulatory adherence through resources and oversight. Compliance committees should meet regularly to review program effectiveness and challenges. These forums enable senior management to address issues and allocate necessary resources. Clear policies and procedures guide staff in executing compliance responsibilities effectively. Documentation should cover all aspects of monitoring, investigation, and reporting processes.

Performance Metrics and Testing

Regular testing validates monitoring system effectiveness and identifies improvement opportunities. Organizations should conduct both automated testing and manual scenario reviews. Key performance indicators measure program success objectively. Metrics should include alert accuracy rates, investigation times, and SAR filing timeliness. Independent audits provide objective assessments of compliance program quality. Third-party reviews identify gaps that internal assessments might overlook.

Continuous Improvement Process

Compliance programs must evolve continuously to address emerging threats and regulations. Organizations should establish formal processes for updating policies, procedures, and systems. Feedback loops enable learning from alerts, investigations, and regulatory interactions. These insights drive refinements that improve detection accuracy and operational efficiency. Industry collaboration helps organizations stay informed about best practices and threats. Participating in information-sharing initiatives strengthens collective defense against financial crime.

Conclusion

Real-time blockchain threat monitoring represents a critical compliance requirement for modern organizations. Regulatory frameworks continue evolving, demanding sophisticated monitoring capabilities and proactive threat detection. Successful implementation requires comprehensive technical infrastructure, skilled personnel, and executive commitment. Organizations must balance regulatory requirements with operational efficiency and customer experience considerations.

FAQs

Real-time blockchain threat monitoring is the continuous analysis of blockchain transactions as they occur. This process identifies suspicious activities, compliance violations, and potential fraud instantaneously, enabling immediate response and regulatory reporting.

Multiple regulations mandate blockchain monitoring, including the Bank Secrecy Act, FATF Travel Rule, and EU’s MiCA regulation. These frameworks require organizations to implement systems for detecting money laundering, terrorist financing, and sanctions violations.

Real-time monitoring analyzes transactions as they execute on the blockchain, typically within milliseconds. Traditional monitoring often operates on batch processing schedules, creating delays between transaction occurrence and detection of suspicious activities.

Key challenges include handling high transaction volumes, tracking cross-chain movements, monitoring privacy-focused cryptocurrencies, and managing false positive alerts. Organizations must also integrate monitoring systems with existing compliance infrastructure.

Organizations should evaluate solutions based on detection accuracy, scalability, regulatory expertise, integration capabilities, and vendor support quality. Solutions should demonstrate proven effectiveness through case studies and offer comprehensive training and implementation assistance.