The blockchain ecosystem faces sophisticated threats daily. Security breaches cost organizations millions in digital assets and reputation damage. Real-time blockchain threat monitoring has become essential for protecting crypto transactions and smart contracts. Modern blockchain networks process thousands of transactions per second. Malicious actors exploit vulnerabilities within milliseconds. Traditional security measures can’t keep pace with these evolving threats.

This comprehensive review examines the top 10 solutions available today. We’ll compare features, pricing, detection capabilities, and real-world performance. You’ll discover which tools best fit your security requirements.

What Makes Real-Time Blockchain Threat Monitoring Critical?

Blockchain networks operate 24/7 without central oversight. Threats emerge from multiple attack vectors simultaneously. Flash loan attacks, rug pulls, and smart contract exploits happen in seconds. Real-time monitoring detects anomalies as they occur. Immediate alerts enable rapid response to potential threats. This proactive approach prevents losses before they escalate. The average crypto hack costs $15 million according to recent industry data. Early detection reduces financial impact by up to 80%. Speed matters when protecting digital assets.

Key Features to Look For

Effective monitoring solutions share several essential characteristics. Transaction pattern analysis identifies unusual activity instantly. Behavioral analytics detect deviations from normal network operations. Smart contract auditing capabilities scan for vulnerabilities continuously. Wallet tracking monitors suspicious fund movements across chains. Integration with existing security infrastructure streamlines threat response. API access enables custom security workflows and automation. Multi-chain support protects assets across different blockchain networks. User-friendly dashboards present complex data in actionable formats.

1. Chainalysis Real-Time Monitoring

Chainalysis dominates the enterprise blockchain security market. Their platform combines transaction monitoring with threat intelligence. Law enforcement agencies worldwide rely on their forensic capabilities.

Core Capabilities

The platform tracks transactions across 20+ blockchain networks. Machine learning algorithms identify suspicious patterns in real-time. Risk scoring assigns threat levels to addresses and transactions. KYC integration verifies counterparties before transactions complete. Automated alerts notify teams of high-risk activities instantly. Compliance reporting simplifies regulatory requirements.

Strengths and Limitations

Chainalysis excels at tracking illicit fund flows. Their database contains millions of known threat addresses. Historical data provides context for current threats. However, the platform requires significant investment. Smaller organizations may find pricing prohibitive. The learning curve is steep for new users.

Best For: Large enterprises and financial institutions

Pricing: Custom enterprise pricing starting around $16,000 annually

Multi-chain Support: Excellent (20+ chains)

2. CipherTrace Armada

CipherTrace offers comprehensive cryptocurrency intelligence solutions. Their Armada platform focuses on real-time threat detection. The tool serves both traditional finance and crypto-native companies.

Detection Mechanisms

Advanced analytics identify money laundering patterns instantly. Cross-chain tracking follows funds through complex routing schemes. Sanction screening checks addresses against global watchlists. DeFi protocol monitoring analyzes smart contract interactions. Flash loan detection prevents arbitrage-based attacks. Mixer and tumbler identification reveals obfuscation attempts.

Performance Analysis

CipherTrace processes billions of transactions monthly. Detection accuracy rates exceed 95% for known threat patterns. False positive rates remain below 2% with proper configuration. The platform integrates seamlessly with compliance workflows. API responses occur within 200 milliseconds typically. Custom rule creation enables organization-specific threat detection.

Best For: Exchanges and financial service providers

Pricing: Tiered subscription model, starts at $10,000/year

Multi-chain Support: Very good (15+ chains)

3. Elliptic Navigator

Elliptic specializes in cryptocurrency compliance and risk management. Navigator provides real-time monitoring for digital asset businesses. The platform emphasizes ease of use and rapid deployment.

Monitoring Features

Transaction screening occurs at sub-second speeds. Risk categorization uses proprietary threat intelligence data. Wallet profiling reveals entity types and risk levels. Typology detection identifies specific attack patterns automatically. Case management tools streamline investigation workflows. Regulatory reporting templates simplify compliance documentation.

Practical Applications

Financial institutions use Navigator for AML compliance. Crypto exchanges screen deposits and withdrawals continuously. NFT marketplaces monitor for stolen asset transactions. The platform detected over $10 billion in illicit transactions last year. Integration takes less than two weeks typically. Customer support receives consistently high ratings.

Best For: Mid-sized exchanges and crypto businesses

Pricing: $8,000-$50,000 annually based on transaction volume

Multi-chain Support: Good (12+ chains including major DeFi networks)

4. TRM Labs

TRM Labs focuses on fraud prevention and financial crime detection. Their platform serves both traditional and decentralized finance sectors. Real-time alerts help teams respond to threats immediately.

Technical Architecture

The system processes 1.5 billion blockchain events daily. Proprietary algorithms detect emerging threat patterns. Entity attribution connects wallets to real-world identities where possible. Smart contract risk scoring evaluates DeFi protocols automatically. Network analysis reveals relationships between suspicious addresses. Threat feeds update continuously with new intelligence.

Differentiation Factors

TRM maintains one of the largest crypto threat databases. Their research team publishes cutting-edge security insights regularly. Custom investigation tools support complex forensic work. The platform offers excellent customer training resources. Implementation support ensures successful deployment. Regular feature updates address emerging threats quickly.

Best For: DeFi platforms and crypto-native companies

Pricing: Custom pricing, typically $15,000+ annually

Multi-chain Support: Excellent (major chains plus Layer 2 solutions)

5. SecuredApp Blockchain Security Suite

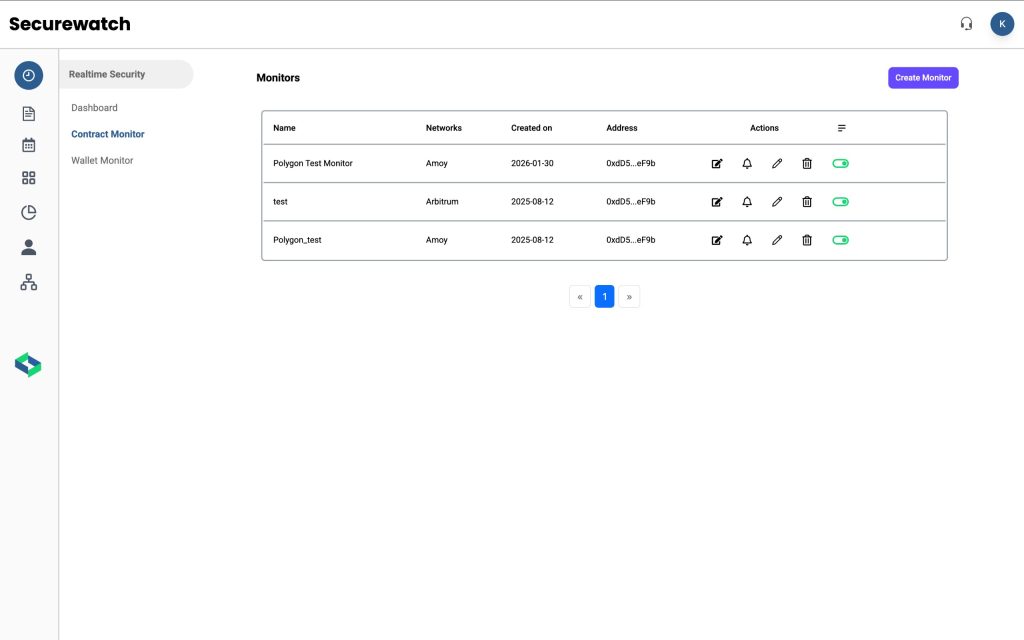

SecuredApp provides comprehensive blockchain security for modern enterprises. Our real-time threat monitoring integrates with broader application security strategies. The platform emphasizes prevention and rapid response.

Integrated Protection

Our solution monitors blockchain transactions alongside application-level threats. Smart contract analysis identifies vulnerabilities before deployment. Automated penetration testing validates security postures continuously. Real-time dashboards display threats across your entire infrastructure. Custom alert rules match your specific risk profile. API integration enables automated security responses.

Unique Advantages

SecuredApp combines blockchain monitoring with traditional application security. This unified approach prevents siloed security operations. Your team manages all threats from one platform. Our machine learning models adapt to your specific use cases. False positives decrease as the system learns your patterns. Dedicated security experts support your team 24/7.

The platform scales effortlessly from startups to enterprises. Transparent pricing ensures predictable security budgets. Implementation typically completes within one week.

Best For: Companies needing comprehensive security beyond just blockchain

Pricing: Flexible plans starting at $5,000/year

Multi-chain Support: Growing (major chains with regular additions)

Special Features: Unified security management, application-level integration

6. Forta Network

Forta represents a decentralized approach to blockchain security. Community-driven detection bots monitor networks continuously. The platform operates as a real-time threat intelligence network.

Decentralized Architecture

Independent security researchers create specialized detection bots. These bots scan blockchain transactions for specific threats. Alerts distribute through the network instantly. Anyone can develop and deploy custom detection logic. Economic incentives ensure bot operators maintain quality. The community validates threat reports collaboratively.

Community Strength

Over 100 detection bots monitor Ethereum and Polygon networks. Coverage includes DeFi exploits, NFT fraud, and governance attacks. New bots launch weekly addressing emerging threats. The decentralized model prevents single points of failure. No central authority controls threat detection parameters. Open-source code enables complete transparency.

Best For: DeFi protocols and decentralized applications

Pricing: Free for basic use, paid tiers for premium features

Multi-chain Support: Currently focused on EVM-compatible chains

7. AnChain.AI

AnChain.AI leverages artificial intelligence for blockchain security. Their platform detects threats through behavioral analysis. The system learns from historical attack patterns continuously.

AI-Powered Detection

Deep learning models analyze transaction graphs in real-time. Anomaly detection identifies previously unknown threat patterns. Predictive analytics forecast potential vulnerabilities before exploitation. Natural language processing analyzes social engineering attempts. Computer vision examines NFT metadata for fraud indicators. Reinforcement learning optimizes detection accuracy over time.

Innovation Focus

AnChain pioneers AI applications in blockchain security. Their research team publishes frequently in academic journals. The platform incorporates latest machine learning advances rapidly. Detection capabilities improve continuously without manual updates. Custom model training addresses industry-specific threats. Explainable AI features help teams understand threat assessments.

Best For: Organizations prioritizing cutting-edge AI capabilities

Pricing: Enterprise pricing, typically $20,000+ annually

Multi-chain Support: Good (major chains and select DeFi protocols)

8. Coinfirm AML Platform

Coinfirm specializes in anti-money laundering for cryptocurrency businesses. Their platform combines compliance with real-time monitoring. Regulatory focus makes them popular with traditional financial institutions.

Compliance-First Design

Risk reports meet requirements across multiple jurisdictions. Automated KYC/AML screening reduces manual review time. Audit trails document all security decisions comprehensively. Enhanced due diligence workflows handle high-risk transactions. Sanction list checking updates within minutes of government announcements. Compliance certification assists with regulatory examinations.

Regulatory Expertise

Coinfirm maintains relationships with regulators globally. The platform updates immediately when regulations change. Legal teams can access compliance experts directly. Pre-configured rule sets address specific jurisdictional requirements. Custom policies reflect your organization’s risk appetite. Detailed documentation supports legal and compliance teams.

Best For: Regulated financial institutions entering crypto markets

Pricing: $12,000-$60,000 annually based on needs

Multi-chain Support: Adequate (major chains and stablecoins)

9. Merkle Science

Merkle Science offers real-time transaction monitoring and forensics. Their platform emphasizes speed and accuracy. Asian markets particularly favor their solutions.

Speed Optimization

Transaction screening completes in under 100 milliseconds. Parallel processing handles extreme transaction volumes. Infrastructure scales automatically during peak periods. Real-time risk scoring enables instant transaction decisions. Batch processing analyzes historical data efficiently. Low latency ensures minimal impact on user experience.

Global Coverage

The platform supports major Asian cryptocurrency exchanges. Local compliance expertise addresses regional regulations. Multilingual support serves international teams. Merkle Science maintains strong accuracy across different markets. Cultural nuances in threat patterns receive appropriate attention. Regional threat intelligence enhances detection capabilities.

Best For: Asian market participants and high-volume platforms

Pricing: Volume-based pricing, starts around $10,000/year

Multi-chain Support: Very good (major chains plus regional networks)

10. Solidus Labs

Solidus Labs focuses on market manipulation and trading surveillance. Their platform monitors for wash trading and spoofing. Real-time alerts protect market integrity.

Market Surveillance

Cross-market analysis detects coordinated manipulation attempts. Order book monitoring identifies suspicious trading patterns. Front-running detection protects users from MEV attacks. Pump-and-dump scheme identification prevents retail investor losses. Whale tracking monitors large holder activities. Insider trading detection analyzes unusual pre-announcement activity.

Trading Focus

Solidus excels at protecting trading platforms specifically. Their algorithms understand market microstructure deeply. False positives remain minimal compared to general-purpose tools. The platform integrates with trading infrastructure seamlessly. Real-time intervention prevents market abuse. Regulatory reporting supports CFTC and SEC requirements.

Best For: Cryptocurrency exchanges and trading platforms

Pricing: Custom pricing based on trading volume

Multi-chain Support: Adequate (focuses on major trading pairs)

Comparison Matrix: Key Features

Detection Speed

Chainalysis and CipherTrace offer excellent enterprise-grade speed. TRM Labs and Merkle Science optimize for high-frequency operations. Forta’s decentralized model introduces minimal latency. SecuredApp provides rapid detection integrated with broader security monitoring. Real-time alerts trigger within seconds of threat identification. Our unified platform eliminates data transfer delays.

Coverage Breadth

Chainalysis leads in total blockchain network coverage. TRM Labs excels at DeFi-specific monitoring. Forta provides excellent EVM-compatible chain support. Most platforms support Bitcoin, Ethereum, and major altcoins. Layer 2 solution coverage varies significantly between vendors. Cross-chain tracking capabilities differ in sophistication.

Accuracy Metrics

Elliptic Navigator and CipherTrace maintain highest accuracy rates. Machine learning platforms like AnChain.AI improve continuously. Community-driven Forta depends on bot quality. False positive rates impact operational efficiency significantly. Premium platforms achieve under 2% false positive rates. Proper configuration remains essential regardless of vendor.

Integration Capabilities

TRM Labs and SecuredApp offer strongest API options. Enterprise platforms provide comprehensive SDK support. Open-source solutions enable unlimited customization. Webhook support varies between basic and advanced implementations. Data export formats affect downstream analytics capabilities. Real-time streaming versus batch processing creates different workflows.

Pricing Considerations

Enterprise platforms require substantial annual investments. Chainalysis and AnChain.AI command premium pricing. Mid-tier solutions offer better value for smaller organizations. Transaction-based pricing suits high-volume operations. Flat-rate subscriptions provide budget predictability. Free tiers like Forta enable experimentation without commitment.

SecuredApp offers flexible pricing that scales with your needs. Our comprehensive platform eliminates multiple security tool subscriptions. Transparent pricing includes all features without hidden costs. Hidden costs include implementation services and training. Ongoing support fees add to total ownership costs. Integration development may require additional resources.

Implementation and Support

Deployment complexity varies dramatically between platforms. Cloud-based solutions offer fastest time to value. On-premise installations require significant IT resources. Training requirements range from hours to weeks. User interface quality impacts team adoption rates. Documentation completeness affects self-service success.

Customer support quality proves crucial during incidents. 24/7 availability matters for global operations. Response times during actual threats can make critical differences. SecuredApp provides white-glove implementation support. Our team ensures successful deployment within your timeline. Ongoing training keeps your staff current on emerging threats.

Making the Right Choice

Assess your organization’s specific security requirements first. Consider transaction volumes and blockchain networks used. Evaluate budget constraints realistically. Enterprise organizations benefit from comprehensive platforms like Chainalysis. Mid-sized companies should consider Elliptic or TRM Labs. Startups might start with Forta or SecuredApp’s entry tiers.

DeFi-focused operations need specialized capabilities. Trading platforms require market surveillance features specifically. Multi-chain operations demand broad network support. Integration with existing security tools matters significantly. Unified platforms like SecuredApp reduce operational complexity. Standalone blockchain tools may create security silos.

The Future of Blockchain Threat Monitoring

Artificial intelligence will increasingly drive threat detection. Predictive capabilities will identify vulnerabilities before exploitation. Automated response systems will neutralize threats instantly. Cross-chain analysis will become standard practice. Interoperability monitoring will track assets across entire ecosystems. Privacy-preserving analytics will balance security and confidentiality.

Decentralized monitoring networks may supplement centralized platforms. Community-driven intelligence will democratize threat detection. Hybrid models combining both approaches will likely emerge. Regulatory requirements will drive adoption further. Compliance-focused features will become table stakes. Real-time monitoring will transition from optional to mandatory.

Conclusion

Real-time blockchain threat monitoring protects your digital assets effectively. The platforms reviewed offer varying strengths and specializations. Your specific needs determine the optimal choice. Enterprise organizations require comprehensive solutions with proven track records. Chainalysis, CipherTrace, and TRM Labs serve this market well. Their premium pricing reflects extensive capabilities and support. Mid-market companies benefit from balanced solutions like Elliptic Navigator. Cost-effective options provide essential protection without excessive features. Implementation speed and ease matter for resource-constrained teams.

SecuredApp delivers comprehensive security extending beyond blockchain monitoring. Our integrated approach protects your entire digital infrastructure. Flexible pricing and expert support ensure success regardless of organization size.